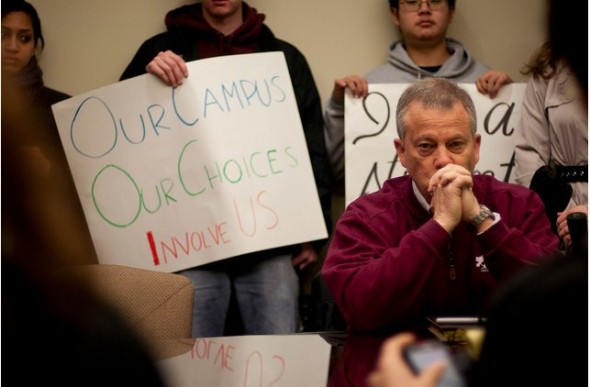

Students Demand Greater Financial Transparency from University Administrators

Students at schools from California to Vermont are delivering letters to their college presidents to demand greater transparency about agreements between their schools and financial institutions. Below is just one of many letters that will be delivered this week.

Students at schools from California to Vermont are delivering letters to their college presidents to demand greater transparency about agreements between their schools and financial institutions. Below is just one of many letters that will be delivered this week.

President Gottfredson,

We are writing to call on you to publicly disclose all partnerships and agreements University of Oregon has with financial institutions to market debit and prepaid cards, preferred private student loans, deposit accounts, financial aid disbursement, and other products to students.

Currently, the University of Oregon is only required to make these disclosures about college credit cards under the Credit Card Accountability, Responsibility, and Disclosure (CARD) Act, but we believe the University of Oregon’s administration needs to take a step further in being responsible and transparent to prospective, current, and past students, and the larger community built around our school.

A report released by the U.S. Government Accountability Office on February 13, 2014 titled, “College Debit Card: Actions Needed to Address ATM Access, Student Choice, and Transparency” details consumer concerns related to fees passed onto students, a lack of free ATM access, and a host of other issues summarized in the report’s findings, which read, in part: “Schools or card providers appeared to encourage students to enroll in a college card rather than present neutral information about payment options.” The report recommends that debit and prepaid card providers be required to file their college financial agreements with the Consumer Financial Protection Bureau for public review. This reflects the need for transparency to ensure that members of our campus community can make financial decisions with unbiased information.

On December 17, 2013, the Director of the Consumer Financial Protection Bureau, Richard Cordray, called upon financial institutions to disclose these partnerships and agreements. As Director Cordray stated: “Students and their families should know if their school, whether well-intentioned or not, is being compensated to encourage students to use a specific account or card product. When financial institutions secretly give kickbacks to schools, they are engaging in risky practices.” We agree with him wholeheartedly, which is why students and professors on our campus are echoing their call for public disclosure.

It is our belief that making these agreements public and available for all students and their families on the University of Oregon website would signify your commitment to the well-being of our campus, and to the transparency standards to which other organizations are routinely held. Failing to disclose these partnerships will continue potential consumer risks for students and reflect poorly upon our university.

Sincerely,

University of Oregon Student Labor Action Project

League of Educators and Students Slashing Tuition

You are in point of point your perfect website owner. The site packing swiftness is usually amazing. Evidently your are performing virtually any exclusive tip. On top of that, This contents are generally masterwork. you could have conducted a wonderful practice in this particular matter!

I wanted to thank you for this wonderful read!! I definitely enjoyed every little bit of

it. I have you book-marked to look at new stuff you post…

Magnificent beat ! I would like to apprentice even as you amend your web site, how can i subscribe for

a blog website? The account helped me a appropriate deal.

I were tiny bit acquainted of this your broadcast provided shiny clear concept